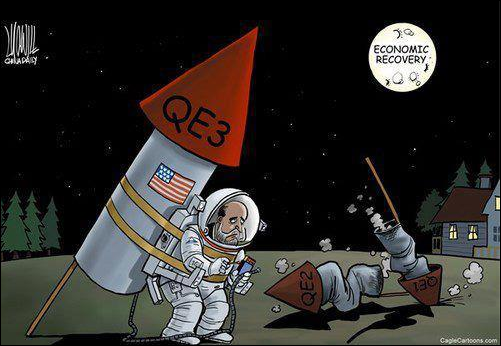

Bernanke’s QE3 moonshot last week--a promise to pour $50 billion a month of money created out of thin air into US mortage markets until something happens, he knows not what--has already got local morons calling for the same non-golden shower to be sprayed around markets here. In the hope, perhaps, that some of that stream will splash out on them. Who nows?

Detlev Schlicter explains a few of the many hazards of not just out and out monetary inflation quantitative easing, but the dangers of stimulus, to infinity and beyond:

There was a beautiful symmetry to last week’s policy announcement by the Fed. Precisely a week after the ECB had pledged its commitment to unlimited purchases of Euro Zone government bonds, the Fed declared that its new round of debt monetization – ‘quantitative easing’ or QE3 – would be open-ended.

Unlimited, open-ended. The concept of stimulus has certainly evolved since the crisis started… “We will do whatever it takes” was a phrase that was much used in the early part of this crisis, around 2008. No doubt it was meant to instil confidence, yet it is one of the scariest things a policymaker can say. If policies go wrong – or have unintended consequences, as they always do – the costs are born by society. We should be concerned if those who are entrusted with the privileges of state power declare that they will use these powers without limits – the power to tax, the power to regulate, the power to legislate, and the power to print money. On Thursday Bernanke declared that he would not stop his policy until it has the results that he believes it should have…

The decision for unlimited QE is also a sign of defeat. QE2 had not delivered what Bernanke had told us it would… Stimulus sounds harmless but every stimulus is intervention. And the iron law of intervention is that once you intervened you have to intervene again, you cannot just stop the intervention without undoing the results of previous interventions. QE is state intervention in the market. There is no natural end to it. Bernanke de facto admitted that much last week…

Avoiding the collapse of the financial house of cards has been one objective of monetary policy in recent years, but simply maintaining the financial system in a state of arrested collapse is not enough. We need growth. And the Fed has only one means of creating growth, that is, by artificially cheapening credit and massaging various asset prices up and their yields down with the help of the printing press. That is obviously the same policy that got us into the crisis in the first place…

The bottom line is this: QE is no longer unconventional. It is the new normality. The central bank not only manipulates – persistently and systematically – short term interest rates and the supply of bank reserves so that credit remains constantly cheap, it now also manipulates the shape of the government yield curve, the cost of state borrowing, and risk premiums in the mortgage market. All of this requires ongoing balance sheet expansion at the Fed and open-ended money printing. And there is no exit strategy.

This will end badly.

Well, some economists…

1 comment:

Big Ben really has to avoid only one thing and that is hyperinflation. That's not totally true in that he also has to avoid the politicians declaring that they own the Federal Reserve and all that yummy money printing process.

Pixilated pixelation of petabucks is the fear of hyperinflation as it would destroy the US$ and those who own the printing presses as well as all those who believed "In God We Trust" which replaced "In Gold We Trust". "In God We Trust" really means "Let's Trust Big Ben and the Politicians Not To Wreck This While We're Holding It".

They can get away with some inflation which is just a continuing fee for the use of the money, much like a royalty rate for intellectual property.

When there is panicky deflationary pricing, the pixelation process provides Big Ben with a vast stack of loot with which he can buy assets at a cheap price. The Hong Kong government did it in the Great Asian Contagion of 1998. Hong Kong bought a vast amount of shares from the Hang Seng market. They subsequently sold them after the recovery for a huge profit. That enabled them to retired the previous money and keep the change. Nice work if you can get it.

Big Ben is doing the same but he's buying giga$bucks of real estate securities. He can't really lose because the money he uses costs zero, being freshly pixelated and computers can produce lots of 0s and 1s really fast at really low cost. He can just go on diluting the money until there is so much of the stuff around that prices stop going down.

There is a very old saying "Don't bet against the Fed". The fact is that they can outbid everyone combined. Unless the politicians ruin the game and the politicians had better not do that because pitchforks on Main Street are really bad news for people in power.

Big Ben's buying doesn't create economic activity, but it does stop panicked selling and cascading debt implosion collapse before markets can clear the debris through the long and winding process of legal disputes over ownership.

Gold bugs are betting on US$ implosion but that's a bad bet. The huge entitlement bludger and government spiv fiscal cliff is the big problem. Big Ben can do nothing about that except explain why it's a cataclysmic calamitous catastrophe looming, though he can dilute the US$ debts by way of the pixelation process so the bludgers and government "workers" are poorer than they thought, but the politicians will still have to refuse pay increases. And the dilution rate of US$ might not be enough to keep up with the tsunami of entitlement overwhelming the productive people.

Post a Comment