Guest post by Frank Hollenbeck

It is not an exaggeration to say the current reputation of economists is probably just below that of a used car salesman. [A reputation that is highly deserved. – Ed.]

It is not an exaggeration to say the current reputation of economists is probably just below that of a used car salesman. [A reputation that is highly deserved. – Ed.]

The recent failures of economic policies to boost growth or employment have tarnished this image even more. This, however, is in sharp contrast to the past when economists were seen as the intellectual roadblock to popular misconceptions, bad ideas, or more importantly, government policies sold to the public on false assumptions. Popular slogans such as “protecting local jobs” play on nationalism, but in reality only serve special interests.

The economist of the past would never have hesitated to highlight the fallacies in such reasoning.

Most economists today, however, have sold themselves to the enemy. They work for government agencies such as the IMF, OECD, World Bank, central banks, think tanks or academic institutions where their “output” is either bought or heavily subsidised by government agencies. To succeed they have to “toe the line.” You don’t bite the hand that feeds you.

Today, these economists and bought-and-paid-for journalists inform us almost daily, for example, of the dangers of “deflation” and the risks of “low-flation,” and how only the printing press can protect us from this alleged catastrophe. Yet there is neither theoretical or empirical justification for this fear. On the contrary, falling prices caused by rising production are a positive boon; and a stable money supply would allow prices to better serve the critical function of allocating resources to where they are most needed.

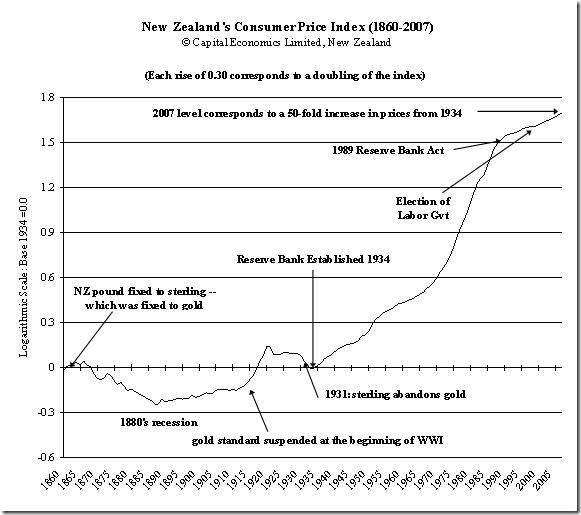

The fact you will never hear from today’s bought-and-paid-for economic historians is that growth resulting from stable money would normally be associated with rapidly falling prices -- as was the case during most of the nineteenth century…

![[Gold-Century-web[4].jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhwxYPsBetXu4Xo6z4CFZqwP1g4_0vFJo49D8ud38stoTunnF-mw86W39FBhJMAtUpaPJ2Sg5-1wbZsa9d7Dd1okxSSLdg8y5WxIADMqIoSk1UbkYtirBhXEQz3Wrev7LsueuRz/s1600/Gold-Century-web%5B4%5D.jpg)

Course of prices in New Zealand and UK, 1860-1910,

from J. Muriel Prichard’s Economic History of New Zealand

…but not however in the twentieth-century’s era of unstable money.

Economists’ willingness to drink the Kool Aid goes further than just drivel on deflation.

When President Obama first talked about raising the minimum wage, or example, Nobel Laureate Paul Krugman quickly published an article supporting such an increase. Yet even a first-year student in economics knows price controls distort the resource-allocation function of prices, thus benefiting one group or special interests at the expense of the rest of society. Although some will receive a higher minimum wage, many others will simply be thrown under the bus. A political pundit should not be masquerading as an economist.

Economists also have “physics envy” and are enamoured with empiricism and mathematical models. To work in a central bank you have to be familiar with, if not a quasi-expert on, DSGE models. The problem with these models, or any economic model, is that the parameters are not constant, most of the variables are interrelated with constantly changing interrelationships -- and omitted variables, like expectations, some of them immeasurable, are conveniently assumed away as unimportant. That is like taking a road map of shipping lanes and omitting the islands.

Unlike the reaction to noise from the zombies in the walking dead, humans do not react necessarily to the same events in the same way. Economists at the Fed must be scratching their heads as to why businesses did not react to lower interest rates as it did after the dot-com bubble. It’s the old adage of “fool me once, shame on you; fool me twice, shame on me.”

When one attains a Ph.D. in a physical science like physics or medicine, he does not spend time understanding theories from 200 years ago. The profession is always moving forward, right? Yet in economics, a social science, we wrongly take the same attitude. Macroeconomics as a profession has not advanced but has regressed. We had a better understanding of macroeconomics 80 years ago. Politicians put Keynes on a pedestal because he gave them the theoretical foundation to justify policies that had been justifiably ridiculed in the past by the classical economists.

These economists such as Smith, Say, Ricardo, Bastiat and Mill fought hard to dispel the popular misconception that the problem was overproduction and a lack of money. Today, the leading economists are telling us everything will be fine if we can “boost demand” (hence, too much production) or have more money through quantitative easing. These are the same popular misconceptions promulgated by mercantilists 250 years ago. The difference, today, is that economists are the mercantilists’s ally instead of their enemies.

The role of the economist should be to explain not only the direct effects of economic policies, but also the indirect effects . The economists should not only tell us what is seen, but what is not seen -- and more importantly what should be foreseen. Economists in unison should have informed the public that the massive government spending after the crash of 2008 would have created more growth and employment if the money had been left in private hands. To fund “cash for clunkers,” the government borrowed money and called forth resources that would normally have been used to build plants and equipment or capital goods, the real source of growth in an economy. As Murray Rothbard eloquently said, this is a transfer of “resources from the productive [private sector] to the parasitic, counterproductive public sector.”

We live on a planet with a constraint called gravity. We can adapt to the law of gravity by creating innovations such as airplanes, but we cannot defy the law of gravity by jumping off a building without a parachute. The same is true in economics and of the law of scarcity. We falsely believe that somehow if government legally counterfeits intrinsically worthless paper or spends someone else’s money we will be able to upend the law of scarcity.

J.B. Say once said that economists should be “passive spectators” who do not give advice. He could have added, “and do not sleep with the enemy.

Frank Hollenbeck teaches finance and economics at the International University of Geneva. He has previously held positions as a Senior Economist at the State Department, Chief Economist at Caterpillar Overseas, and as an Associate Director of a Swiss private bank.

This post first appeared at the Mises Daily. It has been lightly edited.

No comments:

Post a Comment